USOR Token Analysis: Are BlackRock or “Trump-Tagged” Wallets Really Involved?

An in-depth educational analysis of the USOR token, examining on-chain data, market narratives, risks, and unverified claims around oil tokenization.

Cryptocurrency markets often react quickly to narratives that combine real-world assets, institutional names, and political branding. In early 2026, the U.S. Oil Reserve (USOR) token became a focal point of such attention, driven by speculation about oil tokenization, institutional wallet activity, and politically tagged addresses.

This article provides an educational, fact-based overview of what USOR is, why it is drawing attention, what can be verified on-chain, and which claims remain unconfirmed. The goal is to help readers understand the project without hype or financial advice.

What Is the USOR Token?

USOR (U.S. Oil) is a Solana-based SPL token promoted around the concept of oil-related asset tokenization. According to publicly available blockchain data, the token exists on the Solana network and is actively traded on decentralized exchanges.

Core Characteristics

-

Blockchain: Solana

-

Token standard: SPL

-

Supply: Approximately 999 million tokens

-

Trading venues: Solana-based decentralized exchanges

USOR’s website and promotional material suggest a connection to oil reserves. However, no U.S. government agency has confirmed that the token is backed by physical oil or linked to the U.S. Strategic Petroleum Reserve. Blockchain technology can verify token transfers, but it cannot independently confirm real-world commodity custody without trusted third-party attestations.

Why USOR Is Drawing Attention in 2026

Several broader trends help explain the visibility of USOR:

-

Growing interest in real-world asset (RWA) tokenization

-

Public discussions by large asset managers about blockchain settlement (in unrelated products)

-

Increased speculation around politically branded crypto narratives

When these themes intersect, even limited on-chain activity can attract widespread attention on social media, regardless of whether formal partnerships exist.

Does BlackRock Have Any Involvement With USOR?

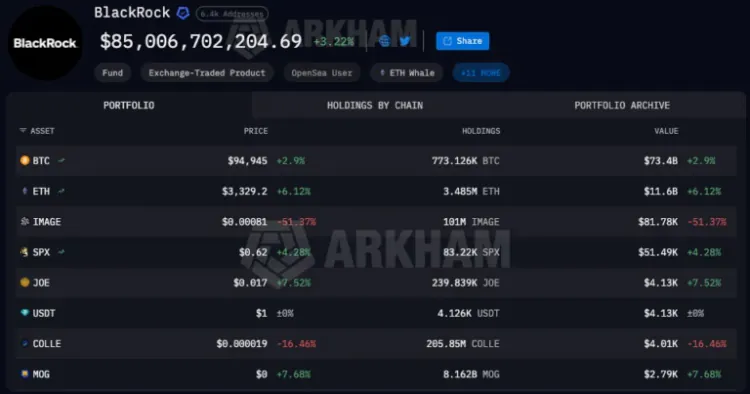

Speculation about BlackRock’s involvement in USOR stems from wallet-labeling tools used by on-chain analytics platforms. These tools apply heuristic methods based on transaction patterns, not confirmed ownership records.

Important Clarifications

-

Wallet labels are not official confirmations

-

No filings, statements, or disclosures link BlackRock to USOR

-

Public entity trackers do not list USOR among BlackRock holdings

Large institutions often interact indirectly with blockchain infrastructure through custodians or service providers, which can create misleading assumptions when viewed without context.

Are Politically Tagged Wallets Accumulating USOR?

Another narrative involves wallets labeled as connected to previous politically themed crypto activity. These labels are usually based on historical trading behavior, not identity verification.

What This Means

-

A wallet’s prior interaction with political tokens does not prove political affiliation

-

Labels are often community-generated

-

There is no evidence of official political coordination with USOR

Historically, politically branded tokens have experienced high volatility, driven more by attention cycles than fundamentals.

Market Activity: Liquidity and Trading Volume

Public market data shows that USOR has:

-

Active liquidity pools on Solana DEXs

-

Noticeable daily trading volume

-

Frequent retail participation

While this confirms market interest, trading activity alone does not validate claims about oil backing, institutional partnerships, or long-term utility.

| Claim | Status | Evidence |

| Backed by U.S. Oil | Unverified | No official government or DOE confirmation. |

| BlackRock Accumulation | False/Speculative | Based on heuristic wallet tags, not official disclosures. |

| Trump Team Involvement | Unconfirmed | Likely community-tagged wallets from previous cycles. |

| Solana-Based SPL Token | TRUE | Verifiable on-chain activity on the Solana network. |

Where Is USOR Traded?

USOR is traded primarily on Solana-based decentralized exchanges. Users typically need:

-

A Solana-compatible wallet

-

SOL for transaction fees

-

Verified token contract addresses

Safety Reminder

-

Always verify token contracts

-

Be cautious of similarly named tokens

-

Decentralized trading offers no consumer protection

Is USOR a Legitimate Token?

Technically:

-

The token exists and functions on Solana

-

Transactions are publicly verifiable

Institutionally:

-

No confirmed partnerships

-

No government endorsement

Regulatorily:

-

Not registered as a commodity or security

-

No verified link to physical oil reserves

Legitimacy in crypto can be technical without implying real-world asset backing.

Key Risks to Consider

1. Verification Risk

Blockchain cannot independently confirm off-chain oil reserves without trusted attestations.

2. Liquidity Risk

Liquidity levels can change quickly, increasing volatility.

3. Regulatory Risk

Tokenized commodity narratives may face future regulatory scrutiny.

4. Narrative Risk

Market behavior may be influenced more by speculation than fundamentals.

Tokenized Oil Narratives and Market Psychology

Oil is a geopolitically sensitive commodity. When crypto projects adopt national or reserve-related branding, it can create assumptions of stability or legitimacy that may not exist.

USOR’s visibility highlights how quickly story-driven narratives can shape market sentiment. While interest can grow rapidly, it can also fade once claims are examined more closely.

FAQs

What is the USOR token?

USOR is a Solana-based cryptocurrency promoted around oil tokenization concepts. There is no public confirmation that it is backed by government-held oil reserves.

Is USOR backed by the U.S. Strategic Petroleum Reserve?

No. The U.S. Department of Energy has not confirmed any connection between USOR and the Strategic Petroleum Reserve.

Is BlackRock involved with USOR?

There is no verified evidence or official disclosure showing BlackRock ownership, sponsorship, or endorsement of USOR.

Are politically tagged wallets proof of insider involvement?

No. Wallet tags are heuristic labels and do not confirm identity, affiliation, or coordination.

Disclaimer

This article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency markets are volatile and involve risk. Readers should conduct independent research and consult qualified professionals before making financial decisions.