What's the difference between hot and cold crypto wallets?

Learn the difference between hot and cold wallets, how each stores your private keys, their pros and cons, and how to choose the right crypto wallet for security and convenience.

Cryptocurrency offers financial freedom, but it also comes with one major responsibility—protecting your digital assets. Whether you're a beginner or an experienced investor, you’ve likely heard the terms hot wallet and cold wallet. These two wallet types serve different purposes and provide different levels of security.

This guide explains what hot and cold wallets are, how they work, and how to choose the right one for your needs.

Introduction to Hot and Cold Wallets

Although your cryptocurrency lives on the blockchain, your wallet stores the private keys needed to access and control your funds. The type of wallet you choose can dramatically affect the security of those private keys.

Why Wallet Choice Matters

Choosing the right wallet helps protect against:

-

Malware

-

Hacks

-

Phishing attacks

-

Loss of private keys

Understanding the difference between hot and cold wallets helps you stay in control of your assets.

What Are Hot Wallets?

A hot wallet is a software-based crypto wallet connected to the internet. These wallets run on mobile apps, desktop software, or browser extensions.

Common examples include:

-

Trust Wallet

-

MetaMask

-

Coinbase Wallet (mobile)

-

Phantom

-

OKX Wallet

How Hot Wallets Work

Hot wallets generate your seed phrase and private keys online. Because they operate through the internet, they allow for fast and easy transactions.

Advantages of Hot Wallets

-

Very convenient

-

Ideal for daily transactions

-

Quick access to funds

-

Works seamlessly with decentralized apps

Disadvantages of Hot Wallets

-

Private keys are stored online

-

Higher risk of hacking or malware

-

Not recommended for storing large amounts long term

What Are Cold Wallets?

A cold wallet stores your private keys offline, making it one of the safest ways to store cryptocurrency. Most cold wallets are hardware devices.

Examples include:

-

Ledger Nano S Plus

-

Ledger Nano X

-

Trezor Model One

-

Trezor Model T

-

SafePal S1

How Cold Wallets Work

Cold wallets store your private keys inside secure hardware chips that remain offline. Even if connected to a compromised computer, the keys cannot be extracted.

Advantages of Cold Wallets

-

Maximum security

-

Protected from online attacks

-

Best for long-term storage

-

Ideal for holding large amounts of cryptocurrency

Disadvantages of Cold Wallets

-

Less convenient for everyday use

-

Physical device needed for access

-

Cost varies depending on the model

-

Requires careful storage to avoid damage or loss

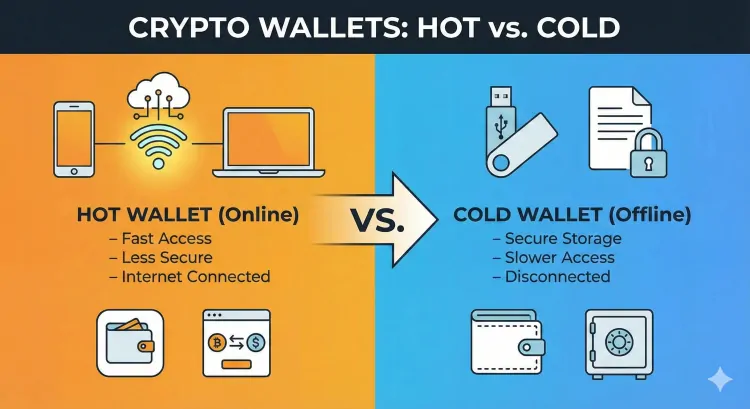

Hot Wallet vs Cold Wallet: Key Differences

1. Internet Connection

-

Hot Wallet: Online

-

Cold Wallet: Offline

2. Security Level

-

Hot Wallet: More vulnerable

-

Cold Wallet: Highly secure

3. Convenience

-

Hot Wallet: Best for frequent transactions

-

Cold Wallet: Best for long-term or high-value storage

4. Cost

-

Hot Wallet: Free

-

Cold Wallet: Requires purchase

Choosing the Right Wallet for Your Needs

Choose a Hot Wallet If:

-

You trade often

-

You use dApps or NFTs

-

You need fast access to crypto

-

You store smaller amounts

Choose a Cold Wallet If:

-

You store crypto long term

-

You want to protect large amounts

-

You prefer maximum security

-

You don’t need daily access to your funds

Using Both: The Hybrid Strategy

Most crypto users benefit from using both types of wallets.

How This Strategy Works

-

Use a hot wallet for quick spending, trading, and dApp use

-

Store the majority of your crypto in a cold wallet

-

Transfer only what you need for daily use

This approach provides convenience without sacrificing security.

Binance Wallet for Beginners

If you’re new to cryptocurrency, managing a hardware wallet or recovery phrase might feel overwhelming. In that case, a Binance hosted wallet is a great starting point.

Benefits include:

-

No need to manage your own private keys

-

No recovery phrase required

-

Easy access from any device

-

Built-in security and protections

-

Perfect for beginners

Open Your Binance Account.

Use this code for 100$ voucher: IZVPQGDC

You can later move your assets to a cold wallet when you're ready.

Common Mistakes to Avoid

-

Storing all your crypto in a hot wallet

-

Saving your seed phrase digitally

-

Using unverified wallet apps or hardware wallets

-

Entering your seed phrase on websites

-

Keeping only one copy of your recovery phrase

Avoid these mistakes to keep your assets safe.

Understanding the difference between hot and cold wallets is essential for anyone entering the world of cryptocurrency. Hot wallets offer convenience and fast access, making them ideal for daily use. Cold wallets provide top-tier security and are ideal for long-term storage.

Many investors choose a hybrid approach, using both types depending on their needs.

If you’re new to crypto, starting with a Binance wallet is a simple, secure way to begin before transitioning to hardware storage.